Investment Attributes

Risk and Return

A key attraction of investing in timberland is its history of producing competitive risk-adjusted returns.

Timberland investment returns are primarily driven by the growth and harvesting of timber in working forests and by changes in the value of the underlying lands upon which that timber is being grown.

The primary benchmarks used to measure private U.S. timberland investment performance are managed by the National Council of Real Estate Investment Fiduciaries (NCREIF). They include: The NCREIF Timberland Property Index, which measures property-level performance on a gross and unlevered basis; The NCREIF Timberland Separate Account Index, which measures before and after fee performance for individually-managed accounts; and, The NCREIF Commingled Fund Index, which measures before and after fee performance for pooled accounts. These three indices are comparable to other such benchmarks managed by NCREIF for other commercial real estate asset classes, including U.S. farmland. Timberland investment management organizations (TIMOs), like TIR, that contribute their performance data to NCREIF for inclusion in the indices are allowed to utilize the data to educate investors about the timberland asset class and to promote their own capabilities.

Comparison of risk and return between the NCREIF Timberland Property Index and the Standard & Poor’s 500 Index (35 Years, 1990-2024)

US Timberland

S&P 500

Sources: Standard & Poor’s, NCREIF, United States Treasury

Time-weighted average annual returns

*The Sharpe ratio assumes a risk free rate of 2.77%, which is the rate of 90-day U.S. Treasury Bills from 1990 to 2024.

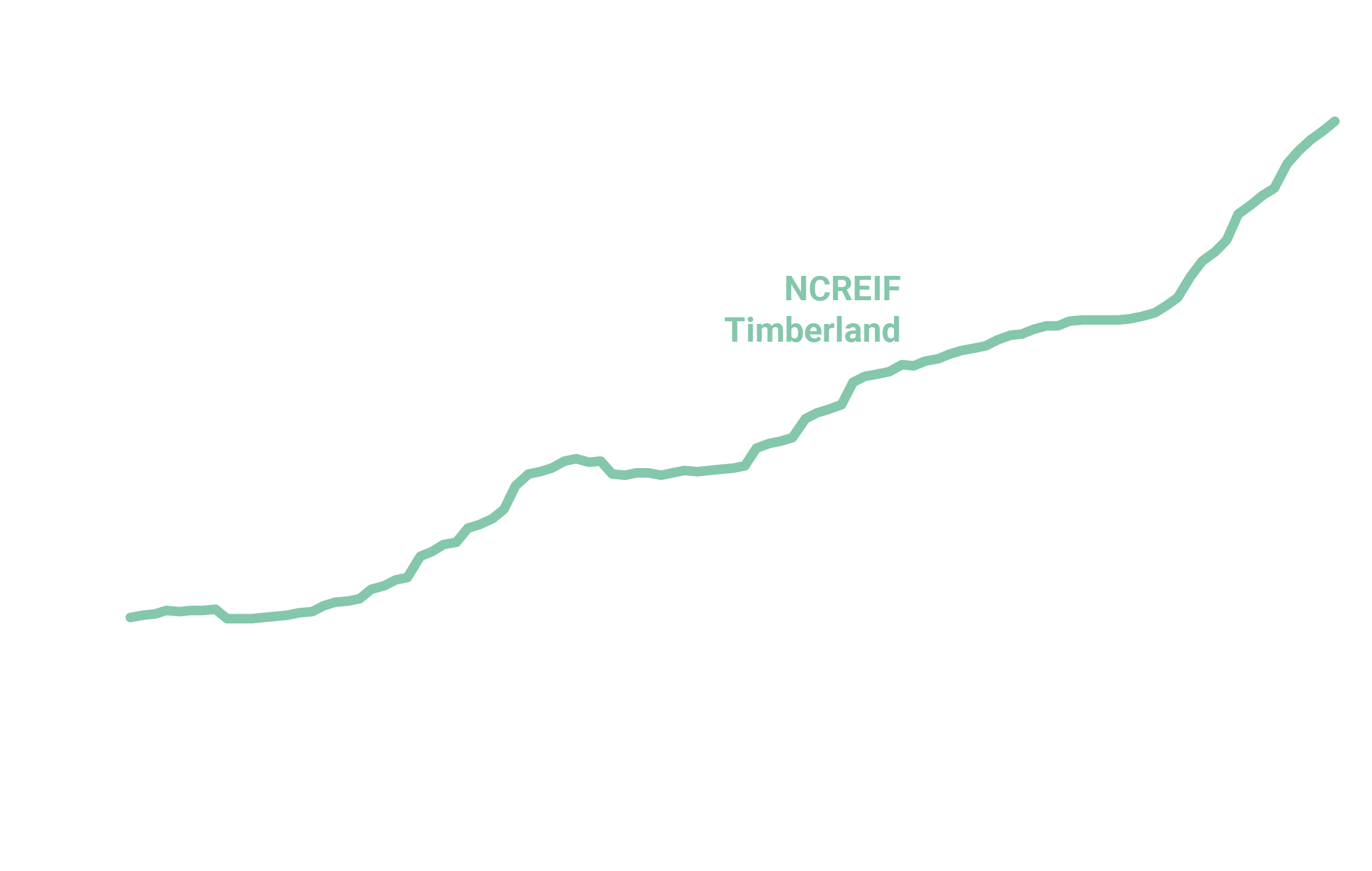

Cumulative Return of Timberland and Equity Indices

25-Year Span (31.12.1999 – 31.12.2024)

Sources: Bloomberg, NCREIF

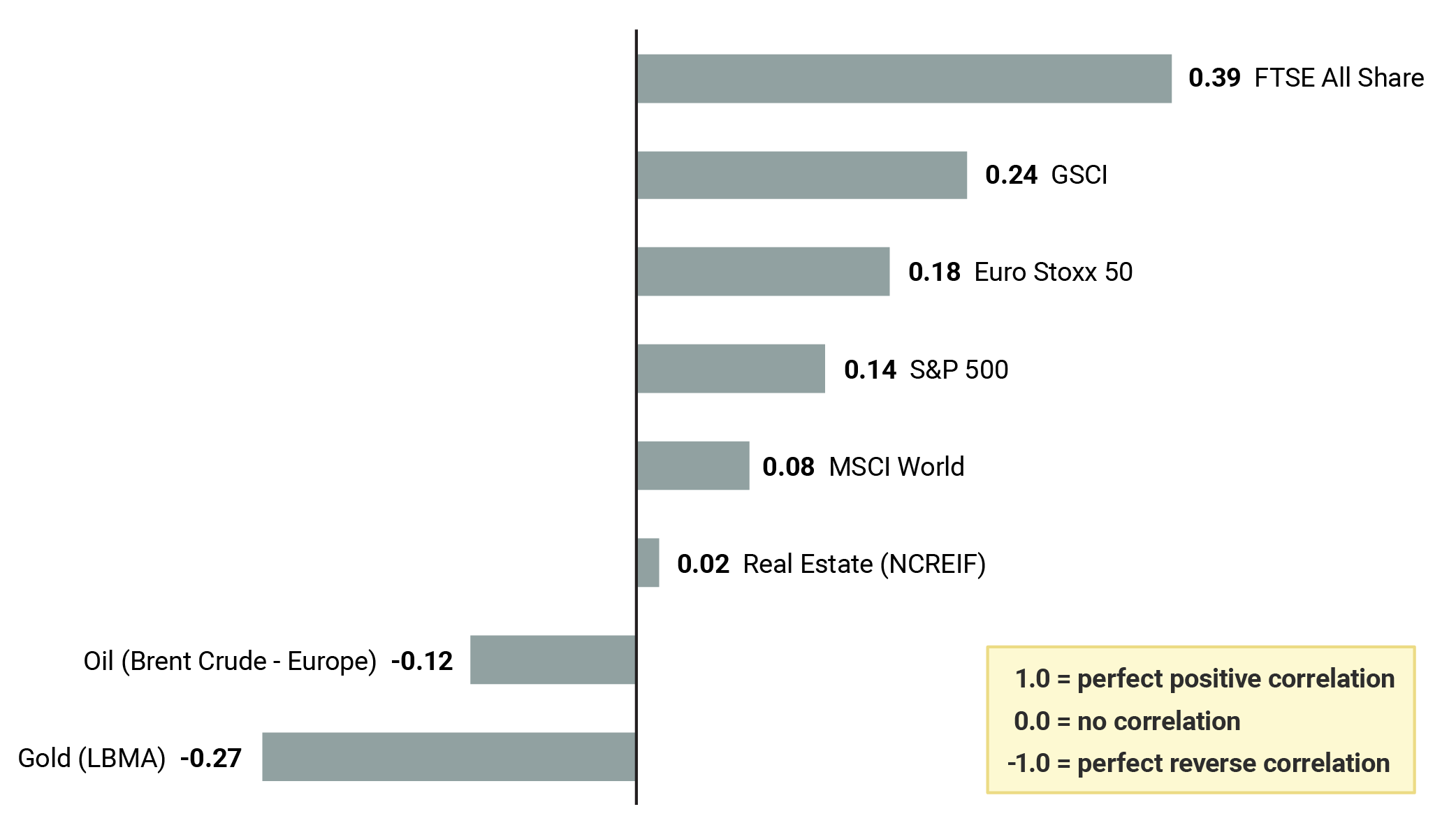

Portfolio Diversification

Another important rationale for holding timberland in an investment portfolio is its capacity to provide diversification benefits. Timberland investment performance has been shown to respond to various macroeconomic and market factors and trends in ways that differ from those of other asset classes. As a result, there are limited correlations between timberland returns and the performance of stocks, bonds, and real estate.

Correlation of the NCREIF Timberland Property Index Annual Returns Against Other Benchmark Indices

(1987–2024)

Sources: Bloomberg, NCREIF

Capital Preservation and Inflation-Hedging Attributes

As a hard asset that offers investors both long-term capital appreciation and the option to time some percentage of their ongoing cash flows to evolving supply, demand and pricing conditions in global timber markets, timberland has been shown to have excellent inflation-hedging characteristics.

Timberland Portfolio Diversification

Dimensions of Risk Mitigation

Spatial

Invest in different countries

Invest across different regional or local markets

Consider the size and distribution pattern of investment properties

Temporal

Hold different maturities or ages of timber

Hold investment funds or accounts of different vintages

Product & Market

Hold different commercial tree species

Grow and sell different log products

Pursue a range of non-timber income sources

Investment Structure & Strategy

Diversify across timberland investment managers or funds

Pursue different investment strategies or models

Buy different types of timber assets, such as fee simple, cutting rights and timber leases

Unique Characteristics

Aside from offering competitive risk-adjusted returns and portfolio-diversification benefits, timberland also has other unique characteristics that institutional and high-net-worth investors usually find attractive. Among others, these include ongoing value accretion due to the biological growth characteristics of trees; the flexibility to structure and manage investments in response to an investor’s specific risk, return and cash-flow needs; and, the ability to capitalize on certain tax advantages.

Biological Growth

Foresters often describe timberland assets as having characteristics that make them analogous to both a factory and warehouse. That’s because a timberland holding produces a product, timber, that naturally increases in value through time because of biological tree growth. However, that same forest also can behave like a warehouse because it provides the capacity to store that increasing value on the stump until supply, demand and pricing dynamics are advantageous for realizing cash flow.

Timber is an asset that naturally increases in value through time because as a tree increases in size and volume it tends to become more valuable. This is because larger trees are typically used to produce higher-valued products. In many parts of the country, for instance, softwood trees, like pine and fir species, which are often grown in intensively-managed plantations, move through their financial value chain as they grow through their biological life cycles. Trees that are 8 inches in diameter or smaller are considered pulpwood, which is largely used to manufacture low-value products like paper and packaging. Pulpwood also is a common feedstock for bio-energy applications, like renewable fuel pellets. Trees between 8 and 12 inches in diameter fall into the chip-n-saw grade. Chip-n-saw logs are most often used to produce smaller-sized lumber (e.g., 2×4’s) and intermediate-value products like composite building panels, including oriented strand board, which is employed by builders and contractors for wall sheathing and flooring. Finally, trees 12 inches or larger in diameter are considered sawtimber. They are used to manufacture high-value products like dimensional lumber, plywood, paneling, flooring, furniture and decorative veneers.

How does biological growth move a tree through the value chain?

How are the primary grades of timber processed and used to produce end-use products?

Global Timber Product Flows

This relationship between a tree’s biological growth and its financial value means that the negative impact of the time value of money and the risk of negative returns can be offset with a timberland investment because of the increasing timber volumes it generates through time. Likewise, timber price increases tend to have a favorable, compounding influence on the performance of a timberland investment. Furthermore, over the life of a timberland investment, timber value can be “stored on the stump,” which gives investors the latitude to realize cash returns when timber market demand and pricing dynamics are most favorable. This optionality, the capacity to determine when cash flows will be realized, is a unique and highly-prized feature of timberland investment.

Portfolio Structuring

Timberland investment portfolios can be structured to meet a flexible array of investment objectives. Higher cash flows can be achieved by including a greater proportion of mature timber holdings in a portfolio. If capital preservation and long-term asset appreciation are the goals, these can be achieved by acquiring younger working forests whose growth rates can be further enhanced through the application of intensive forest management practices. If an investor seeks a balance between generating intermittent cash flows and fostering long-term asset appreciation, a portfolio can be structured to include a variety of timber age classes.

In addition to these benefits, timberland returns can be improved by utilizing a range of sophisticated investment structuring and management strategies. These can include employing leverage; selling sub-sets of properties that have real estate development, conservation or recreation potential; and, even utilizing cash flows to support the issuance of asset-backed securities. In short, timberland investments can be shaped with techniques to meet a variety of goals for investors.